Five Forces

Description

Michael Porter’s innovative research in the 1980’s changed managers’ perceptions of their own industry’s importance as a factor for their company’s strategy. Business unit managers would now have to study their industry’s characteristics since an industry’s structure determines its relative economic attractiveness and hence, the profit potential of all companies within that particular industry.

Prior to Porter’s publication, economists studying Industrial Organisation explained varying levels of profitability between industries on their structural differences. Porter focused on private policy rather than on public policy, that is, how to maximize profits instead of how to locate excess profits. Industry as a factor changed almost overnight from a given to an important variable in a firm’s strategic decision-making process. Porter made it clear that choosing a firm’s relative competitive position within a selected industry is a decision of secondary importance.

Details

Author Porter, Michael E.

Year 1980

Topic Strategic Management

Framework

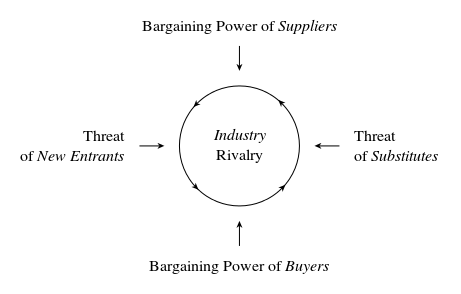

Porter’s framework consists of five fundamental competitive forces:

1. Entry of competitors assessing the ability of new entrants to start operations and the structural barriers they must overcome;

2. Threat of substitutes assessing the ability of new products with superior characteristics to replace existing product(s) or service(s);

3. Bargaining power of buyers assessing the relative strength and number of buyers;*

4. Bargaining power of suppliers assessing the relative strength and number of sellers;*

5. Rivalry among the existing players assessing the relative competitive strength of rival firms.*

* Concentration ratio (CR): the percent of market share held by the four largest firms within an industry is frequently used as a leading measure. A high CR means that few firms hold a large market share, are less competitive, and create a less competitive, more monopolistic landscape. Less competition leads to higher profit margins. A low concentration ratio indicates that an industry is characterized by many rivals, none of which has a significant market share. These fragmented markets are said to be competitive.

Analysis

Quick scan to determine an industry’s attractiveness

- Force 1: Rivalry Determinants

- Force 2: Entry Barriers

- Force 3: Determinants of Substitution Threats

- Force 4: Determinants of Supplier Power

- Force 5 : Determinants of Buyer Power

| Industry growth |

Is your market growing? In a growing market, firms are able to grow revenues simply because of the expanding market. In a stagnant or declining market, companies often fight intensely for a smaller and smaller market.

|

| Concentration and balance |

Is there a small number of competitors? Often the greater the number of players, the more intense the rivalry. However, rivalry can occasionally be intense when one or more firms are vying for market leader positions.

|

|

Is there a clear leader in your market? Rivalry intensifies if companies have similar shares of the market, leading to a struggle for market leadership.

|

|

| Intermittent overcapacity |

Can you store your product to sell at the best times? High storage costs or perishable products result in a situation where firms must sell product as soon as possible, increasing rivalry among firms.

|

| Product differences |

Is your product unique? Firms that produce products that are very similar will compete mostly on price, so rivalry is expected to be high.

|

| Brand identity |

Is your brand an important purchase decision for your clients? If brands are valuable in your industry (reducing the chance that customers switch), it has a negative influence on rivalry. Building brand and changing perceptions takes a long time.

|

| Switching costs |

Is it difficult for customers to switch between your product and your competitors’ products? If customers can easily switch, the market will be more competitive and rivalry is expected to be high as firms vie for each customer’s business.

|

| Fixed (or storage) costs/value added |

Do you have low fixed costs? With high fixed costs, companies must sell more products to cover these high costs.

|

| Informational overcomplexity |

Are your customers not well informed about your products and market? If the product and the market are complicated or hard to understand, the level of rivalry is lower.

|

| Diversity of competitors |

Do you know your competitors? Do you share their backgrounds? The lower the diversity of competitors the less chance of ”consensus breaking” behaviour.

|

| Corporate stakes |

Are your competitors pursuing a low growth strategy? You will have more intense rivalries if your competitors are more aggressive. In contrast, if your competitors are following a strategy of milking profits in a mature market, you will enjoy less rivalry.

|

| Exit barriers |

Is it easy for competitors to abandon their product? If exit costs are high, a company may remain in business even if it is not profitable.

|

| Economies of scale |

Would it be difficult for a new entrant to have enough resources to compete efficiently? For every product, there is a cost-efficient level of production. If challengers can’t achieve that level of production, they won’t be competitive and therefore won’t enter the industry.

|

| Proprietary product differences |

Do you have a unique process that has been protected? For example, if you are a technology-based company with patent protection for your research investments, you enjoy some barriers to entry.

|

| Brand identity |

Are customers loyal to your brand? If your customers are loyal to your brand, a new product, even if identical, would face a formidable battle to win over loyal customers.

|

| Switching costs |

Are the assets needed to run your business unique? Others will be more reluctant to enter the market if the technology or equipment cannot be converted into other uses if the venture fails.

|

| Capital requirements |

Were there high up-front (risky) costs to start your business? The greater the capital requirements, the lower the threat of new competition.

|

| Access to distribution |

Will a new competitor have any difficulty acquiring/obtaining customers? If current distribution channels make it difficult or legally restricted for a new business to acquire/obtain new customers, you will enjoy a barrier to entry.

|

| Absolute cost advantages |

Are there scale-independent cost advantages such as patents, lisences, experienced staff, subsidies, etc.? If so, than these reduce the change of new companies entering your industry.

|

| Proprietary learning curve |

Is there a process or procedure critical to your business? The more difficult it is to learn the business, the greater the entry barrier.

|

| Access to necessary inputs |

Will a new competitor have difficulty acquiring/obtaining needed inputs? Current distribution channels may make it difficult for a new business to acquire/obtain inputs as readily as existing businesses.

|

| Proprietary low-cost product design |

Is there a product design that provides a defendable low cost advantage?

|

| Government policy |

Are regulatory policies set by the government applicable to your market? Do these restrictions limit market access? If so, than it is harder to enter a market, reducing competition.

|

| Expected retaliation |

Do you expect that the chance is high that existing players in the industry will retaliate? If so, than newcomers expect it is harder to enter a market, reducing competition. |

| Relative price performance of substitutes | Does your product compare favourably to possible substitutes? If another (new) product offers more features or benefits to customers, or if its price is significantly lower, customers may decide that the other product is of better value. |

| Switching costs | Is it costly for your customers to switch to another product? When customers experience a loss of productivity if they switch to another product, the threat of substitutes is weaker. |

| Buyer propensity to substitute | Are customers loyal to existing products? Even if switching costs are low, customers may have allegiance to a particular brand. If your customers have high brand loyalty to your product you enjoy a weak threat of substitutes. |

| Differentiation of inputs | Are the products that you need to purchase for your business ordinary? You have more control when the products you need from a supplier are not unique. |

| Switching costs of suppliers and firms in the industry | Can you easily switch to substitute products from other suppliers? If it is relatively easy to switch to substitute products, you will have more negotiating room with your suppliers. |

| Presence of substitute inputs | Are substitute inputs readily available in high enough quantities at an agreeable price? If so, your bargaining power is higher. |

| Supplier concentration * | Are there a large number of potential input suppliers? The greater number of suppliers of your needed inputs, the more control you will have. |

| Importance of volume to supplier | Do your purchases from suppliers represent a large portion of their business? If your purchases are a relatively large portion of your supplier’s business, you will have more power to lower costs or improve product features. |

| Cost relative to total purchases in the industry | Does the product you seek make up a low percentage of your total purchases? If so, your bargaining power is higher. |

| Impact of inputs on cost or differentiation | Is the product you seek non-essential to maintain your stratgic position? If so, your bargaining power is higher. |

| Threat of forward integration relative to threat of backward integration by firms in the industry | Would it be difficult for your suppliers to enter your business, sell directly to your customers, and become your direct competitor? The easier it is to start a new business, the more likely it is that you will have competitors. |

| A. Bargaining leverage | |

| Buyer concentration | Is there no clear leader in the market you are serving? Are there many customers? Your bargaining power is less if you face a large (potential) client. |

| Buyer volume | Do you have enough customers such that losing one isn’t critical to your success? The smaller the number of customers, the more dependent you are on each one of them. |

| Buyer switching costs relative to firm switching costs | Is it difficult for customer to switch from your product to your competitors’ products? If it is relatively easy for your customers to switch, you will have less negotiating power with your customers. |

| Buyer information | Are customers uninformed about your product and market? If your market is complicated or hard to understand, buyers have less control. |

| Ability to backward integrate | Would it be difficult for buyers to integrate backward in the supply chain, purchase a competitor providing the products you provide, and compete directly with you? The less likely a customer will enter your industry, the more bargaining power you have. |

| Substitute products | Is your product unique? If your product is homogenous or the same as your competitors’, buyers have more bargaining power. |

| Pull-through | The buyer power of wholesalers and retailers is determined by the same rules, with one important addition. Can retailers influence consumers’ purchasing decisions and thus gain significant bargaining power over manufacturers? Can wholesalers influence the purchase decisions of the retailers or other firms to which they sell? If brand identity is important in this industry then pull-through most likely exists. |

| B. Price sensitivity | |

| Price / total purchases | Does your product represent a small expense for your customers? If your product is a relatively large expense for your customers, they’ll expend more effort negotiating with you to lower price or improve product features. |

| Product differences | Provides your product your customer with unique benefits? If so, your bargaining position is better. |

| Brand identity | Is your customer’s brand not important to you or your competitors clients? If brands are not valuable in your customer’s industry, it has a positive influence on your bargaining position. |

| Impact on quality / performance | Provides your product your customer with less cost for quality control given the same performance as competitors’ products? If so, your bargaining position is better. |

| Buyers profits | Are the profits your customers make relatively high? If so, your bargaining power is bigger. Cost will be less of decision making factor. |

| Decision makers’ incentives | Is the purchase decision based on a large extend on incentives provided to decision makers? If so, your bargaining power is bigger. |